Business Insurance in and around Fort Worth

One of Fort Worth’s top choices for small business insurance.

Insure your business, intentionally

Coverage With State Farm Can Help Your Small Business.

Small business owners like you wear a lot of hats. From marketing guru to financial whiz, you do whatever is needed each day to make your business a success. Are you a fence contractor, a lawn care service or an electrician? Do you own a travel agency, a pottery shop or an auto parts shop? Whatever you do, State Farm may have small business insurance to cover it.

One of Fort Worth’s top choices for small business insurance.

Insure your business, intentionally

Small Business Insurance You Can Count On

Your business thrives off your passion tenacity, and having reliable coverage with State Farm. While you make decisions for the future of your business and lead your employees, let State Farm do their part in supporting you with artisan and service contractors policies, business owners policies and commercial liability umbrella policies.

Since 1935, State Farm has helped small businesses manage risk. Contact agent Esmeralda Gutierrez's team to identify the options specifically available to you!

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

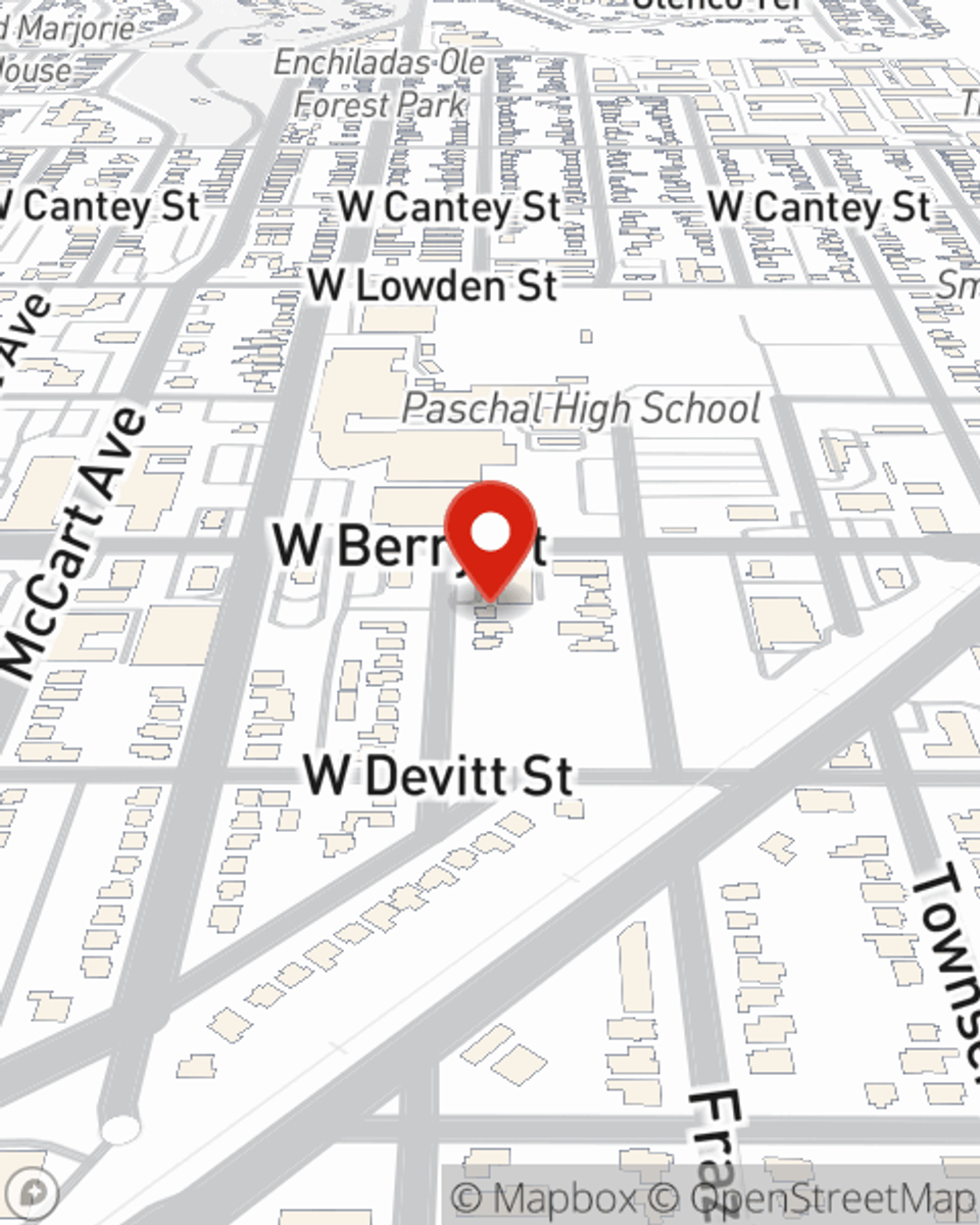

Esmeralda Gutierrez

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.